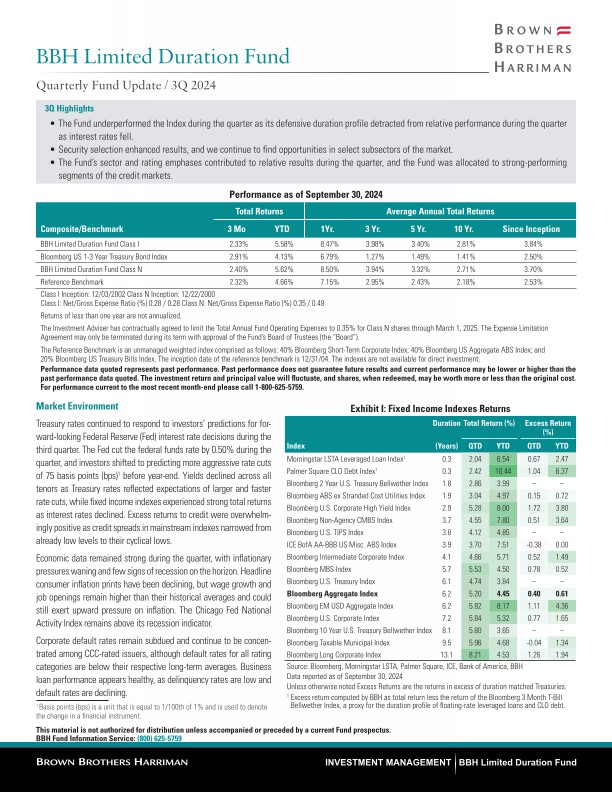

Treasury rates continued to respond to investors’ predictions for forward-looking Federal Reserve (Fed) interest rate decisions during the third quarter. The Fed cut the federal funds rate by 0.50% during the quarter, and investors shifted to predicting more aggressive rate cuts of 75 basis points (bps)1 before year-end. Yields declined across all tenors as Treasury rates reflected expectations of larger and faster rate cuts, while fixed income indexes experienced strong total returnsas interest rates declined. Excess returns to credit were overwhelmingly positive as credit spreads in mainstream indexes narrowed from already low levels to their cyclical lows.

Holdings are subject to change. Totals may not sum due to rounding.

Credit Quality letter ratings are provided by Standard and Poor's, Moody's and Fitch and are presented as the higher of the three ratings. When a security is not rated by Standard & Poor's, Moody's or Fitch, the highest credit ratings from DBRS and Kroll may be used. Absent a rating from these agencies, we may display Private Credit Ratings, if permitted by the issuer, which could include ratings from Egan-Jones Ratings Co. Credit ratings reflect the credit quality of the underlying issues in the portfolio and not of the portfolio itself. Issues with credit ratings of BBB or better are considered to be investment grade, with adequate capacity to meet financial commitments. Issues with credit ratings below BBB are considered speculative in nature and are vulnerable to the possibility of issuer failure or business interruption.

Effective duration is a measure of the portfolio’s return sensitivity to changes in interest rates.

Weighted Average Life of securities excludes US Treasury futures positions.

Yield to Maturity is the rate of return the portfolio would achieve if all purchased bonds and derivatives were held to maturity, assuming all coupon and principal payments are received as scheduled and reinvested at the same yield to maturity. This figure is subject to change and is not meant to represent the yield earned by any particular security. Yield to Maturity is before fee and expenses.

This material is not authorized for distribution unless accompanied or preceded by a current Fund prospectus.

RISKS

Bond prices are sensitive to changes in interest rates and a rise in interest rates can cause a decline in their prices.

Asset-Backed Securities (“ABS”) are subject to risks due to defaults by the borrowers; failure of the issuer or servicer to perform; the variability in cash flows due to amortization or acceleration features; changes in interest rates which may influence the prepayments of the underlying securities; misrepresentation of asset quality, value or inadequate controls over disbursements and receipts; and the security being structured in ways that give certain investors less credit risk protection than others.

Single-Asset, Single-Borrower (SASB) lacks the diversification of a transaction backed by multiple loans since performance is concentrated in one commercial property. SASBs may be less liquid in the secondary market than loans backed by multiple commercial properties.

Foreign investing involves special risks including currency risk, increased volatility, political risks, and differences in auditing and other financial standards.

The Fund also invests in derivative instruments, investments whose values depend on the performance of the underlying security, assets, interest rate, index or currency and entail potentially higher volatility and risk of loss compared to traditional stock or bond investments.

For more complete information, visit www.bbhfunds.com for a current Fund prospectus. You should consider the fund's investment objectives, risks, charges and expenses carefully before you invest. Information about these and other important subjects is in the fund's prospectus, which you should read carefully before investing.

Shares of the Fund are distributed by ALPS Distributors, Inc. and is located at 1290 Broadway, Suite 1000, Denver, CO 80203. Other products are offered by Brown Brothers Harriman.

Brown Brothers Harriman & Co. ("BBH"), a New York limited partnership, was founded in 1818 and provides investment advice to registered mutual funds through a separately identifiable department (the "SID"). The SID is registered with the U.S. Securities and Exchange Commission under the Investment Advisers Act of 1940. BBH acts as the Fund Administrator and is located at 140 Broadway, New York, NY 10005.

Not FDIC Insured No Bank Guarantee May Lose Money

IM-15489-2024-10-23 BBH004000 Exp. Date 01/31/2025